CFO Pessimism Clashes with Tech Industry Optimism Amid Economic Uncertainty

CFOs express growing concerns over economic instability while tech companies remain bullish, leveraging stock surges and AI hype to secure future growth.

Growing Gloom in the C-Suite

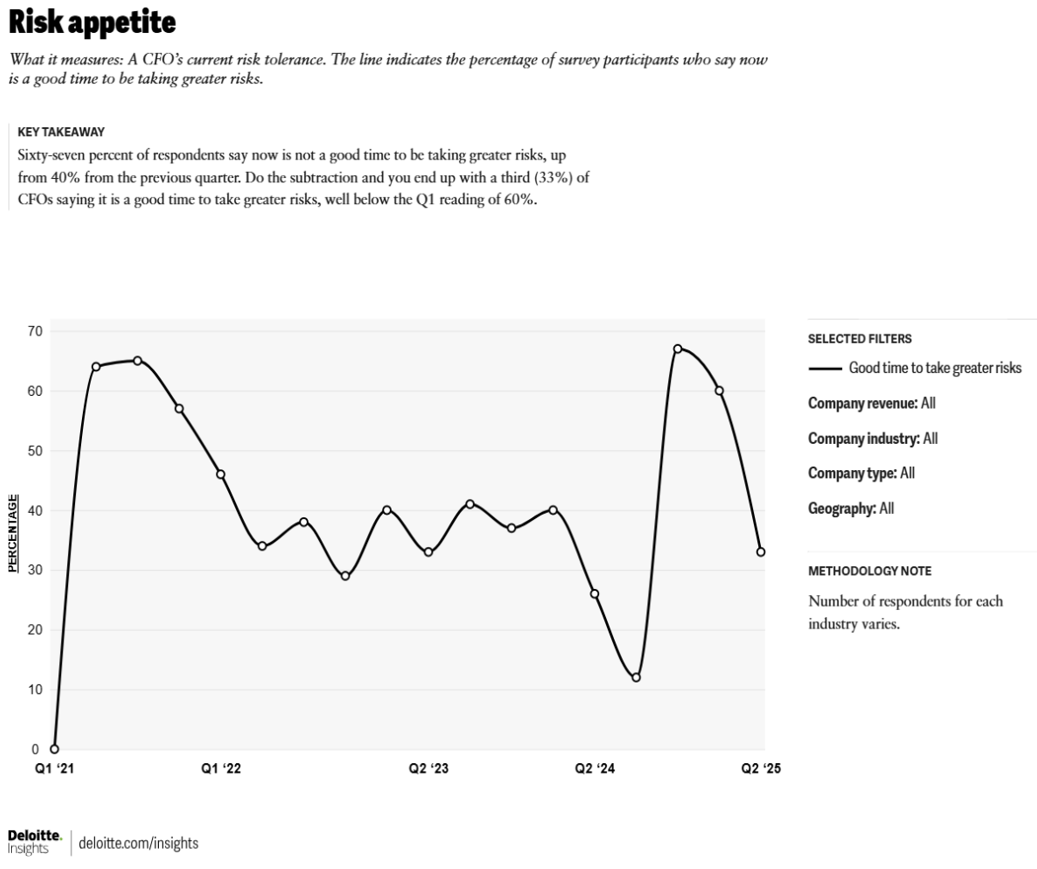

Executives are increasingly pessimistic as they navigate a volatile economic landscape marked by policy shifts, inflation, and rapid changes. Deloitte's CFO Signals survey reveals only one in three financial chiefs believe it's a good time to take risks—the lowest since Q3 2024 and a sharp drop from 60% in Q1. Tariffs and trade policy are pressing concerns, with 40% of CFOs citing them as major issues, matching levels seen during the pandemic-era disruptions.

Tech Sector Defies the Gloom

In stark contrast, the tech industry remains buoyant, with companies like IonQ, D-Wave, and Quantum Computing Inc. raising billions through stock offerings to fund long-term bets on quantum computing. IonQ alone secured $1.68 billion in cash, while CoreWeave leveraged its soaring stock price to acquire Core Scientific for $9 billion, aiming to control its data center infrastructure and reduce costs.

AI Talent Wars Heat Up

Meta CEO Mark Zuckerberg is assembling a "superintelligence" dream team, luring top AI talent with packages reportedly worth up to $200 million. OpenAI CEO Sam Altman is countering with his own hires, but skepticism remains about whether these high-priced teams can deliver. Insider sales at tech firms like Nvidia, Atlassian, and Oracle suggest executives are cashing out amid the euphoria.

Vendor Optimism Meets CFO Skepticism

Oracle CEO Safra Catz touted a $30 billion cloud deal with OpenAI, but questions linger about the sustainability of such long-term commitments. Meanwhile, CxOs are growing weary of AI vendors overpromising on capabilities and ROI. Board sentiment, as tracked by PwC, reflects this caution, with nearly 40% of directors opting for a de-risking strategy due to geopolitical and economic uncertainty.

Key Takeaways

- CFOs are battening down the hatches, while tech firms double down on high-risk bets.

- Quantum and AI companies are using stock rallies to raise capital for future growth.

- AI talent wars are driving salaries to unprecedented levels, but superteams often underdeliver.

- Insider sales suggest tech executives may be hedging their bets.

- Vendor optimism clashes with CxO skepticism, particularly around AI agents and long-term contracts.

Related News

Fed study links AI adoption to rising unemployment in tech

Salesforce and Amazon CEOs highlight AI's role in job displacement as Federal Reserve research shows correlation between AI adoption and increased unemployment.

AI Prodigy Matt Deitke Joins Meta After Zuckerberg Doubles Offer to 250M

24-year-old AI genius Matt Deitke rejected Meta's 125M offer, prompting Mark Zuckerberg to personally intervene and double the package to 250M.

About the Author

Dr. Sarah Chen

AI Research Expert

A seasoned AI expert with 15 years of research experience, formerly worked at Stanford AI Lab for 8 years, specializing in machine learning and natural language processing. Currently serves as technical advisor for multiple AI companies and regularly contributes AI technology analysis articles to authoritative media like MIT Technology Review.